Group Critical Illness Insurance vs Individual: Which One Should You Choose?

Learn the differences between two common types of critical illness insurance.

By Matt Balascak, Content Writer and Podcast Host

12.07.23

As costs for health care continue to rise and people search for options to prevent a serious health event from derailing their financial goals, critical illness insurance is becoming a popular choice for protection. It helps to offset the costs of care by paying you a lump sum of cash in the event of a serious disease or illness so you can pay for treatment and stay on top of other expenses.

In this article, we’ll look at the differences between two common types of critical illness insurance: Group Critical Illness Insurance and Individual Critical Illness Insurance. You’ll learn:

- What is Group Critical Illness Insurance?

- The Benefits of Group Critical Illness Insurance

- Limitations of Group Critical Illness Insurance

- Benefits of Individual Critical Illness Insurance

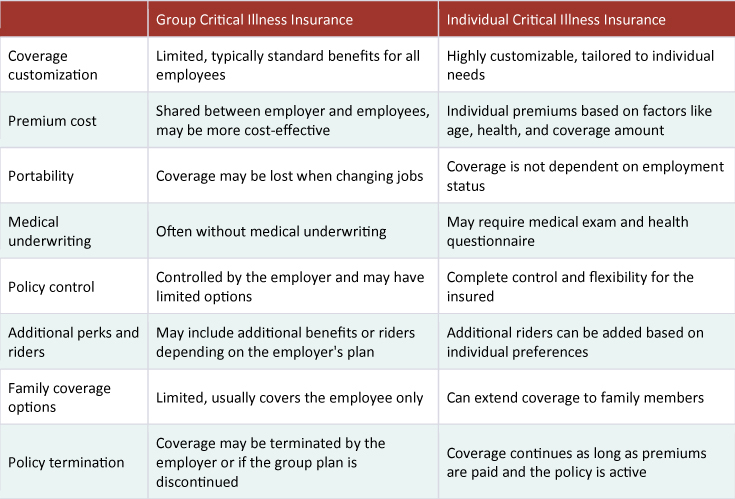

- Individual vs Group Critical Illness Insurance

- Factors to Consider When Choosing

- FAQs

What is Group Critical Illness Insurance?

Group Critical Illness Insurance is a critical illness policy sold to a group of people, typically at a workplace. Everyone in the group has the same options to pick from, often selected by their employer, and they can choose whether or not they want coverage. It’s often offered by employers as a benefit in the same way they may offer life or disability insurance, and it’s a great way for them to increase compensation to employees.

The Benefits of Group Critical Illness Insurance

There are several significant benefits to group critical illness insurance. The cost is often lower than individual critical illness insurance due to payments (or premiums) often being split between the employer and employees, and because the risk is spread over a larger group. It’s also easy to sign up for, you can typically select whether you’d like coverage during your employer’s annual enrollment period without the need for a medical exam.

Some group critical illness plans are portable, meaning you can take them with you if you change jobs or retire. In addition, you might be able to enhance your coverage with optional riders that extend coverage to different diseases and conditions.

Limitations of Group Critical Illness Insurance

There are also some reasons why Group Critical Illness isn’t an ideal solution for everyone. First, it’s often limited to whatever your employer chooses – if you want to customize your coverage, you might not have many options to choose from. There’s also no guarantee you’ll be able to keep your coverage for as long as you want it – your employer might stop offering the plan, or you might change jobs and be unable to keep it.

Benefits of Individual Critical Illness Insurance

Individual critical illness insurance is often purchased through an insurance agent or online (like on criticalillness.com!) and isn’t tied to your employment. The biggest advantage to individual critical illness insurance is that it can be tailored to your unique needs instead of a one-size-fits-all policy for your entire workplace. That means you can choose a plan that makes sense for you and your budget and get protection customized for your life.

If you change jobs or retire, you can keep individual coverage with you no matter what since it isn’t tied to your employment. That makes it easier for you to maintain protection as you get older and are at a higher risk of severe illness.

Individual vs Group Critical Illness Insurance

Factors to Consider When Choosing

When deciding whether to get a group or individual critical illness plan, there are a few items to consider. First is availability – if your employer doesn’t offer a group critical illness plan, it may not even be an option. Or if they offer a plan that’s completely subsidized by the company, you may choose that simply to avoid paying for it yourself. Next, consider what you want from your coverage and whether the group plan can meet your needs. If you want coverage and beyond what your employer offers, you’ll likely need to consider an individual plan.

If you have a complex health history, it may be easier for you to get coverage in a group plan when you can’t qualify for individual coverage. It’s important to fully examine any policy before making a decision, including whether or not you need medical exams, if there are limitations and exclusions, and which conditions are covered. Last, consider whether you’d want to keep your coverage after you stop working for your employer – if so, an individual plan might be the way to go.

FAQs

How does Group Critical Illness Insurance differ from Individual Critical Illness Insurance?

Group Critical Illness Insurance is sold to larger groups, typically the employees of your company. It’s often more affordable and may not require a medical exam, but also offers limited benefits compared to an individual critical illness policy.

What are the main benefits of Group Critical Illness Insurance?

The main benefits of Group Critical Illness Insurance are the ease of application or enrollment and a cost that’s generally lower than individual coverage.

What are the main benefits of Individual Critical Illness Insurance?

Individual Critical Illness Insurance provides more options for customization, allowing you to get coverage that fits your needs instead of the needs of everyone at your company. It’s also easier to keep if you change jobs or retire.

Can I keep the Group Critical Illness Insurance coverage if I change jobs?

It depends on your policy – some are portable, meaning you can transfer the coverage if you leave your job, but with many group plans you’ll lose coverage if you stop being employed for any reason.

Does Individual Critical Illness Insurance require a medical exam?

Whether or not you need a medical exam depends on the policy you choose. Many individual critical illness plans require a medical exam, but not all – Assurity Critical Illness doesn’t require any medical exams for individual coverage.

How do I decide which type of critical illness insurance is right for me?

You should consider which factors are most important to you – if you want easy, standardized coverage that you can sign up for with the rest of your employer-sponsored insurance, you might prefer group coverage. Alternatively, if you want coverage customized for you that can stick with you as you get older, or if your employer doesn’t offer critical illness coverage, you’ll want to look at individual plans. Ultimately, you should compare your options in detail to make a decision.

Making an Informed Decision

Group and individual critical illness insurance are both great ways to protect your finances in case of a serious health event, but they come with their own advantages and disadvantages. Group critical illness insurance often comes with a lower price and ease of enrollment, but individual coverage gives you more options and may provide more robust protection. The most important thing, however, is making sure you get coverage.

You should consider your unique needs and where you are in life – if you’re young and healthy, an individual plan may offer more flexibility and long-term benefits. On the other hand, if you’re older or in poor health, you might find it easier to get coverage in a group plan. You should speak to your local insurance professional or do more research to determine what the best coverage is for you.

Final Thoughts

Critical illness insurance is a smart way to safeguard your financial goals and maintain stability during sudden health emergencies. Whether you choose to get group coverage through your employer or seek out individual coverage like the kind you can get here, you’re taking a great step toward protecting your future. Ready to learn more, or want to see what your price could be for individual coverage? Get a no-commitment quote in moments to see how affordable your coverage can be.

Additional disclosure information

LIMITATIONS AND EXCLUSIONS (may vary by state)

Pre-existing Condition. Pre-existing condition means a sickness or physical condition for which, during the 12 months before the issue date or last reinstatement date, the insured person received medical consultation, diagnosis, advice or treatment from a physician or had taken prescribed medication. No benefits will be paid for a critical illness that is caused by a pre-existing condition unless the date of diagnosis is after the policy has been in force for 12 months from the issue date or last reinstatement date.

Waiting Period. Waiting period means the 30 days following the issue date or ten days following the last policy reinstatement date. The date of diagnosis of a covered critical illness must be made while the coverage is in force and after any waiting period. No benefits will be paid if a diagnosis or a medical consultation that leads to diagnosis of invasive cancer or non-invasive cancer occurs during the waiting period. If cancer is diagnosed during the waiting period, benefits will be paid for a subsequent diagnosis of cancer if the insured person is symptom- and treatment-free for at least 12 consecutive months and in complete remission prior to subsequent diagnosis.

Misstatement of Age and/or Gender. If the insured person’s age and/or gender has been misstated, an adjustment in premiums, coverage or both will be made based on the correct age and/or gender. If, according to the correct age, the coverage provided by the policy would not have become effective or would have ceased, Assurity’s only liability during the period in which the insured person was not eligible for coverage shall be limited to a refund of premiums.

Misstatement of Tobacco Use. If, during the first two years of the policy, the tobacco status of the insured person has been misstated, Assurity will revise the policy’s benefit amount to the amount the premium paid would have purchased using the correct tobacco status on the issue date.

The policy will not pay benefits for losses that are caused by or are the result of an insured person:

- being exposed to war or any act of war, declared or undeclared;

- actively serving in any of the armed forces or units auxiliary thereto, including the National Guard or Army Reserve, except during active duty training of less than 60 days;

- engaging in hang-gliding, hot air ballooning, bungee jumping, parachuting, scuba diving, sail gliding, motor vehicle racing, parasailing, parakiting, mountain or rock climbing, B.A.S.E. jumping, sky diving or cave diving;

- being addicted to drugs or suffering from alcoholism;

- being intoxicated (as determined by the laws governing the operation of motor vehicles in the jurisdiction where loss occurs) or under the influence of an illegal substance or a narcotic (except for narcotics used as prescribed to the insured person by a physician);

- committing or attempting to commit a felony;

- being incarcerated in a penal institution or government detention facility;

- engaging in an illegal occupation;

- intentionally self-inflicting an injury; or

- committing or attempting to commit suicide, while sane or insane.

Policy Form No. I H1820 underwritten by Assurity Life Insurance Company, Lincoln, NE.

IMPORTANT NOTICE— CRITICAL ILLNESS INSURANCE PROVIDES LIMITED BENEFIT COVERAGE. It is not a comprehensive major medical plan or Medicare supplement policy and does not satisfy the requirement for minimum essential coverage under the Affordable Care Act (ACA). It is not a substitute for major medical insurance and may not be appropriate for Medicaid recipients.

This policy may contain reductions of benefits, limitations and exclusions. Click here for standard Limitations and Exclusions. Product availability, features, rates, limitations and exclusions may vary by state. The state specific policy form is the ultimate authority for any questions about this product.

Assurity reserves the right to order, at the company’s expense, evidence of insurability which the company feels is necessary for the prudent evaluation of the risk.

Assurity is a marketing name for the mutual holding company Assurity Group, Inc. and its subsidiaries. Those subsidiaries include but are not limited to: Assurity Life Insurance Company and Assurity Life Insurance Company of New York. Insurance products and services are offered by Assurity Life Insurance Company in all states except New York. In New York, insurance products and services are offered by Assurity Life Insurance Company of New York, Albany, NY. Product availability, features and rates may vary by state.