What is Critical Illness Insurance and How Can it Benefit You?

Help alleviate the financial impact of a serious illness like cancer or Alzheimer's.

By Matt Balascak, Content Writer and Podcast Host

08.01.23

Serious illnesses are seriously common. Diseases like cancer, heart attack and stroke affect millions of people each year, but advancements in medicine are helping more people than ever survive a major health event or diagnosis. Unfortunately, their finances often take much longer to recover, leaving them with lots of medical debt and few options to pay for it. Many turn to crowdfunding websites like GoFundMe, but only a tenth of fundraisers meet their goal.

If you ever face a critical illness, you’ll want the freedom to focus on what’s most important: your recovery.

Read on to see how critical illness insurance might be right for you.

- What is critical illness insurance?

- How does critical illness insurance work?

- What does critical illness insurance cover?

- Is critical illness insurance worth it?

- How much does critical illness insurance cost?

- How do I get the best critical illness policy?

What is critical illness insurance?

Critical illness insurance is known by many names: cancer insurance, heart attack insurance and dread disease insurance are just a few. No matter what it’s called, it’s designed to guard against the financial costs of a serious disease or condition.

Although not every disease is covered, a critical illness insurance policy will cover many of the most common and financially disruptive conditions. It protects against serious illnesses and unexpected medical procedures by giving you the money you need for anything – making up for lost wages, funding extra time off work, covering medical payments and even traveling for treatment. That way you can focus on getting well.

How does critical illness insurance work?

Critical illness insurance is simple – it will pay you a single, lump-sum payment if you’re ever diagnosed with a covered disease or condition. The payment (or “benefit”) is paid directly to you, and you can use the money for whatever you need.

You can use the benefit to pay for treatment, recovery or transportation costs associated with your illness, but unlike your existing health insurance, you’re not limited to medical costs. You can also use the money from a critical illness insurance policy to pay for your mortgage, utility bills, debts, or anything else. It gives you the freedom to recover without setting back your existing financial goals.

Watch this short video to learn how critical illness insurance works.

How much does critical illness insurance cost?

The cost of a critical illness insurance policy depends on the benefit amount you choose. Higher benefit amounts will cost more, and lower benefit amounts will cost less. Generally, critical illness insurance is more affordable than you might think. A benefit amount of $30,000 – which could cover two years of out-of-pocket medical expenses for even the costliest high deductible health insurance plans – could cost less than a dollar a day.

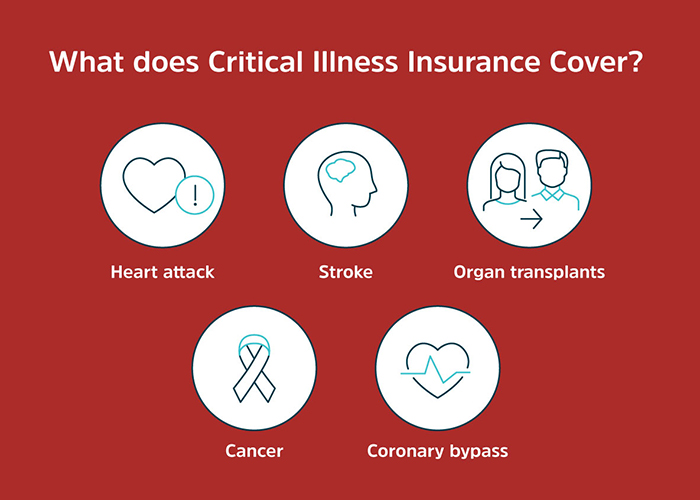

What does critical illness insurance cover?

Critical illness insurance is there to cover your largest medical expenses. Things like chest pain or broken bones won’t qualify for a payment, but a heart attack or cancer diagnosis would be covered. The specific diseases covered depend on your policy, but Assurity Critical Illness Insurance keeps things simple. It’s streamlined to be as affordable and accessible as possible, and covers four of the most common major illnesses:

Invasive or non-invasive cancer*

Heart attack**

Stroke

Advanced Alzheimer’s Disease

Learn more: What does Critical Illness Insurance Cover?

Is critical illness insurance worth it?

Let’s find out if critical illness insurance is right for you. We’ll need to consider a few factors, including the risks of being diagnosed with a critical illness, the increasing chances of survival and the medical costs associated with care.

Learn more: Is Critical Illness Insurance Worth It?

The risk of diagnosis

There are millions of serious diseases diagnosed every year – you probably know someone who’s suffered from cancer, heart attack or stroke. Cancer is the most common, with almost 1.8 million Americans receiving a diagnosis in 2020. Heart attacks and stroke aren’t far behind, with 805,000 heart attacks and 795,000 strokes occurring in the US every year. Stroke remains the number one cause of adult disability.

The odds of survival

While serious conditions are more common than we’d like, there’s good news – you’re more likely than ever to survive a diagnosis. By 2030, the National Cancer Institute estimates there will be 22.2 million cancer survivors in the United States. A cancer diagnosis today is far from a death sentence, but the financial consequences are still very real.

The financial burden of critical illness

A staggering 32 percent of Americans had medical debt in 2020, and serious illnesses are responsible for much of that debt. If you have a high deductible health plan (HDHP), your current out-of-pocket maximum could be as high as $14,100. Treatment for cancer or other conditions can be many times that amount, meaning you could be responsible for thousands of dollars in costs all at once. If treatment extends for multiple years, you could face this cost more than once.

In addition to treatment costs, you need to consider transportation and lodging for care, time off work and all the things that make treatment more comfortable. The costs add up quick – but a critical illness insurance policy can help you to be ready.

Advantages of critical illness insurance

You’ve probably already started to realize how valuable financial protection provided by critical illness insurance can help if you’re diagnosed with a serious disease. There are plenty of advantages to this coverage:

Critical illness insurance takes care of expenses that health insurance doesn’t normally cover and helps you meet your out-of-pocket costs

You can use the lump sum payment you can use for anything you need, like replacing lost income, hiring help, or traveling for treatment

No networks, deductibles or co-payment

No restrictions on how you can use the funds, allowing you to choose what’s best for you

Peace of mind knowing you’re covered if a serious illness or condition strikes, allowing you to focus on the most important things in life

Disadvantages of critical illness insurance

Critical illness insurance is one of the best ways to protect against the financial consequences of a serious illness, but it isn’t perfect. Here are a few reasons why critical illness insurance may not be right for everyone:

Critical illness insurance only pays for certain conditions – you may still need to rely on traditional health coverage for other illnesses

You’ll receive just one large payment upon diagnosis, which may need to last for several years

Critical illness insurance does not cover pre-existing conditions

Premiums become more expensive the older you are

What to look for in critical illness insurance providers

It’s important to choose the right provider for your critical illness insurance. There are several factors to keep in mind. Ensure that your provider has a good reputation and strong financial history – it’s important to know that they’ll still be around if you need your coverage. If there are specific diseases or conditions you’re concerned about, you should also make sure that they’re covered by your policy.

You may also want to consider factors like customer service and the cost of coverage. If you want to extend your coverage with additional riders or benefits, you can also check to see what’s available through your provider.

How do I get the best critical illness insurance policy?

Finding the best critical illness policy can seem like a challenge – there’s no way to know when and if you’ll be diagnosed with a serious illness, or what that diagnosis might be. But there are a few things you can do to make sure you have the best possible critical illness coverage.

First, consider what you already know: How much money do you have in your savings or emergency fund? Do you have a high deductible health plan (HDHP), and if so, what’s your deductible? A good starting place for coverage is making sure you have enough to cover your out-of-pocket costs, or the total of your health insurance’s deductible and coinsurance.

Since critical illness insurance gives you the freedom to pay for things outside of medical costs, you might want to consider including enough coverage for transportation, lodging, time off work, or experimental treatments. Think about what you might use the money for to get an estimate of how much coverage you need. Typical coverage amounts range from ten to fifty thousand dollars.

Last, find out how much your coverage might cost. You can start by getting a quote for Assurity Critical Illness to see your price – it might be less than you think! If you like what you see, you can apply and get coverage in just minutes.

FAQs

What is critical illness insurance?

Critical illness insurance is an insurance policy that pays a large lump sum if you’re diagnosed with a covered serious illness or condition.

What types of illnesses are covered under a critical illness insurance policy?

The exact illnesses and conditions depend on your policy, but Assurity Critical Illness keeps things simple by covering four of the most common conditions: Cancer, heart attack, stroke and Advanced Alzheimer’s Disease.

Is critical illness insurance expensive?

Critical illness insurance is generally quite affordable. Depending on your age and how much coverage you’d like, it can range from a few cents per day to a few dollars per day. You can get a personalized quote here to find your price.

What is the waiting period before I can make a claim on my critical illness insurance policy?

There is a 30-day waiting period for diagnoses of Invasive Cancer and Non-Invasive Cancer. No benefits will be paid if you’re diagnosed in this period.

Can I purchase critical illness insurance if I have a pre-existing medical condition?

Some pre-existing conditions may make you ineligible for coverage, and benefits may not be paid if you suffer a critical illness that’s caused by a pre-existing condition.

Get a quote for Assurity's Critical Illness Insurance coverage

All that’s left now is to find out how much coverage is right for you and apply – your price is probably lower than you think! Get a quote now to see how affordable your coverage can be.

When you’re ready to move forward, applying is fast and easy – you could be covered in just minutes. Check out Assurity’s Critical Illness Insurance for more information or to get your price.